MICR Check Printing – Tips for Improving results

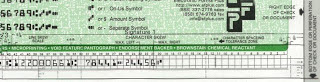

Chances are these days if your business has the technology of this century you may be printing your own checks rather than writing them out by hand. If so then you are probably also familiar with MICR printing. MICR stands for Magnetic Ink Character Recognition. This process uses a specialized toner that usually contains an iron oxide so that a check reader can properly read the symbols at the bottom of the check that make a routing and account number.

In rolling out printers for the last year I have discover 3 major pieces that can really smooth your results out and have 100% passing rate for your checks.

1. Uniform Document

The first thing in any type of document that gets printed is that no matter what content may change the format and placing of certain areas are uniform. For example on a check you may change who the check is to. You might even have a summary of what all the check includes on the check register section. These items must not move the routing number.

2. Clean Printer

One of the biggest failures for checks that go to banks is excess or messy toner. If there is to much toner on a page then its like looking through a window covered in mud. On the other hand if not enough toner gets put on the checks then it will be hard to see anything.

- Clean and vacuum out printer to get excess dust and toner out of the printer.

- Before you put toner in shake it so that the toner will evenly distribute across the cartridge.

3. Printer Alignment

Printer alignment is one of the easiest yet sometimes hardest to find for troubleshooting a printer. Most of the time it will be in a special diagnostic mode for the printer. In most cases it is best to find the Service Manual which is not the same as a User Manual. On a lexmark this setup is called Registration. From here you can set the top, bottom, left and right margins and shift the form of the check so that it can fit in the proper place.

Now that you know a bit about how to improve your check printing and get consistent results, you need to have a tool to measure how well you did. For check printing there is a little plastic tool that you can purchase, or if your lucky a bank or the manufacturer of the printer may send you. This is called a MICR Guage, or MICR Document Template.

Once you have completed these items you should be well on your way to delivering successful checks to your customers.